Financial Markets

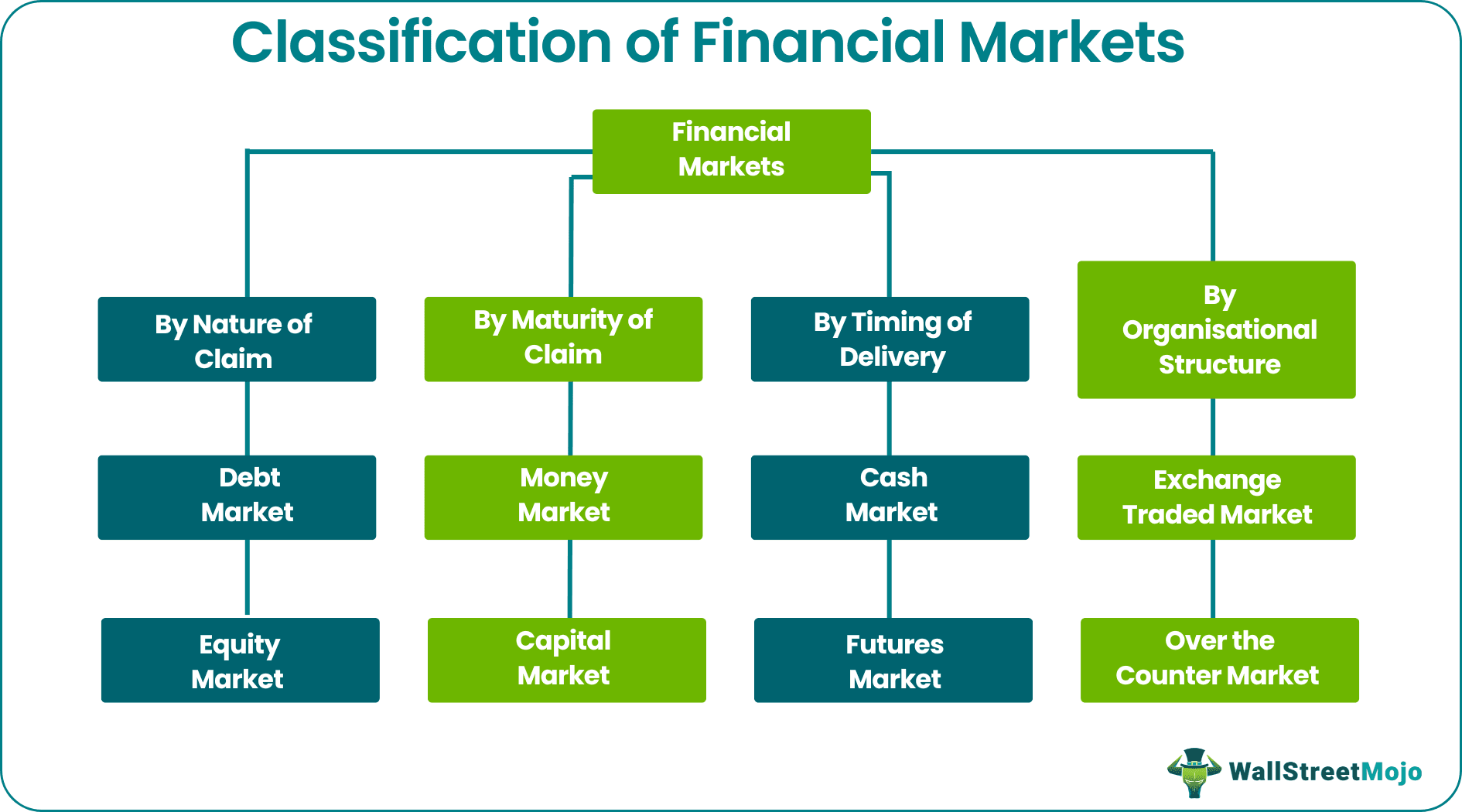

The term ‘financial markets,’ is a fairly broad one, referring to a marketplace where financial assets can be bought and sold. For example, the selling of equities, bonds and currencies.

Financial markets are the lifeline behind capitalist economies, allowing businesses and entrepreneurs to buy and sell their financial holdings. As such, they create securities products which provide a return for those who have excess funds (=investors) and then make these available to those who need additional capital (=borrowers).

A common example of a financial market which you may already be familiar with is a stock exchange, such as the New York Stock Exchange (NYSE), which trades trillions of dollars each day by buying and selling shares of publicly traded companies.

equity = the value of the shares issued by a company

share = one of the equal parts into which a company's capital is divided

bond = a certificate issued by a government or a public company promising to repay borrowed money at a fixed rate of interest at a specified time

currency = a system of money in general use in a particular country

stocks = all the shares by which ownership of a corporation or company is divided

futures = agreements to buy and sell particular shares, goods, etc. on a particular date in the future at a fixed price

over-the-counter market = a market in which shares are bought and sold directly on a computer system rather than through a stock market

lifeline = a thing on which someone or something depends or which provides a means of escape from a difficult situation

excess funds = funds that are remaining after paying taxes, costs, and all expenses of a tax sale